Home>Business and Finance>Discover The Surprising Feature Of Cash App: Bank Statements Revealed!

Business and Finance

Discover The Surprising Feature Of Cash App: Bank Statements Revealed!

Published: January 12, 2024

Uncover the unexpected banking capabilities of Cash App and take control of your business and finance with detailed bank statements. Discover the hidden features now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Regretless.com, at no extra cost. Learn more)

Table of Contents

Introduction

Cash App has become a ubiquitous tool for managing personal finances, offering a seamless platform for sending and receiving money, investing in stocks, and even purchasing Bitcoin. However, one often overlooked feature of Cash App is the provision of bank statements, which can offer valuable insights into your financial activities. Understanding and accessing these bank statements can provide a clearer picture of your spending habits, income sources, and overall financial health.

The availability of bank statements within the Cash App ecosystem is a surprising and beneficial feature that many users may not be aware of. It adds a layer of transparency and accountability to your financial transactions, empowering you to track and analyze your money management with greater precision. In this article, we will delve into the details of Cash App bank statements, exploring how they can be accessed, the benefits they offer, and potential considerations to keep in mind.

By uncovering the nuances of Cash App bank statements, users can harness the full potential of this financial tool, gaining deeper insights into their monetary activities and making informed decisions to enhance their financial well-being. Let's embark on this exploration to uncover the hidden gem of Cash App's bank statements and discover how they can elevate your financial management experience.

Understanding Cash App Bank Statements

Cash App bank statements serve as comprehensive records of your financial transactions and activities within the Cash App platform. These statements provide a detailed overview of the funds flowing in and out of your Cash App account, offering valuable insights into your spending patterns, income sources, and overall financial behavior.

When you access your Cash App bank statements, you gain visibility into various aspects of your financial activities, including:

-

Transaction History: The bank statements meticulously document all the transactions conducted through your Cash App account, such as money transfers, purchases, and investments. This detailed transaction history allows you to track your spending and identify areas where you can optimize your financial management.

-

Income Tracking: By reviewing your bank statements, you can monitor the inflow of funds into your Cash App account, whether they originate from employment, peer-to-peer payments, or other sources. This feature enables you to gain a clear understanding of your income streams and assess your financial stability.

-

Expense Analysis: The bank statements provide a breakdown of your expenditures, categorizing them into different types of transactions. This breakdown allows you to analyze your spending habits, identify recurring expenses, and make informed decisions to allocate your funds more efficiently.

-

Investment Records: For Cash App users engaged in stock trading or cryptocurrency investments, the bank statements include details of these transactions. This feature enables you to review your investment activities and assess their impact on your overall financial portfolio.

Understanding Cash App bank statements empowers users to take control of their finances by providing a comprehensive view of their monetary interactions within the Cash App ecosystem. By leveraging this feature, individuals can gain valuable insights into their financial behaviors, identify areas for improvement, and make informed decisions to enhance their financial well-being.

How to Access Cash App Bank Statements

Accessing your Cash App bank statements is a straightforward process that empowers you to gain valuable insights into your financial activities within the platform. Follow these simple steps to retrieve your bank statements and unlock a comprehensive overview of your monetary interactions:

-

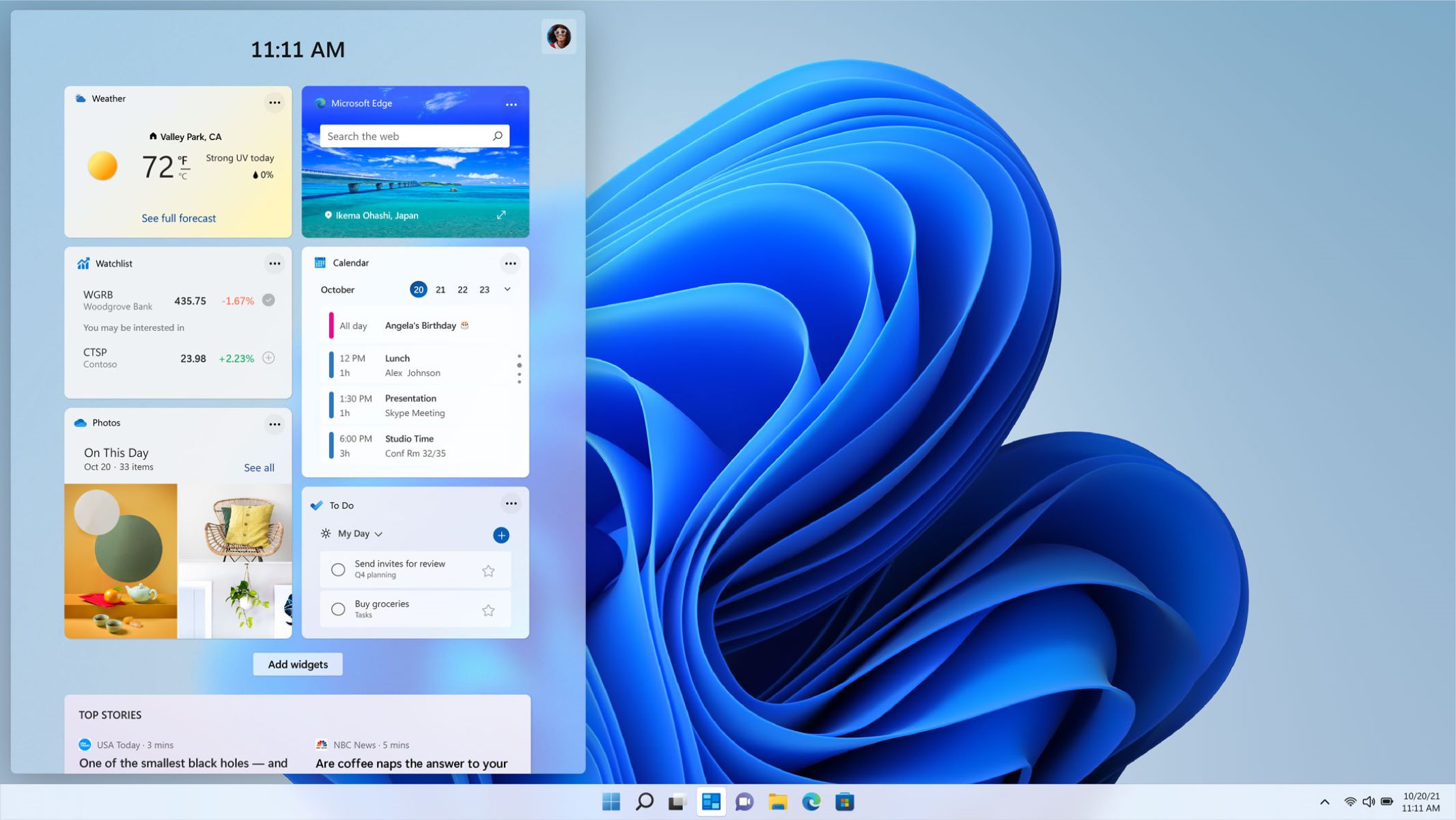

Launch the Cash App: Begin by opening the Cash App on your mobile device. Whether you are using an iOS or Android device, the process for accessing your bank statements remains consistent across platforms.

-

Navigate to the Activity Tab: Within the Cash App interface, locate and tap on the "Activity" tab. This tab serves as a central hub for reviewing your transaction history and accessing essential financial records.

-

Select Statements: Once you are in the Activity section, look for the "Statements" option. This feature allows you to access your bank statements, providing a detailed breakdown of your financial transactions and activities.

-

Choose the Desired Timeframe: Upon selecting the "Statements" option, you will have the opportunity to specify the timeframe for the bank statements you wish to review. Whether you want to assess your monthly, quarterly, or yearly financial activities, Cash App offers the flexibility to tailor your statement retrieval based on your preferences.

-

Review and Analyze: After selecting the timeframe, the Cash App will generate your bank statements, presenting a comprehensive overview of your financial transactions, income sources, expenses, and investment activities. Take the time to review and analyze these statements, leveraging the valuable insights they provide to enhance your financial management approach.

By following these steps, you can seamlessly access your Cash App bank statements, gaining a deeper understanding of your financial behaviors and leveraging this knowledge to make informed decisions regarding your monetary interactions within the Cash App ecosystem. The ability to access comprehensive bank statements within the Cash App platform empowers users to take control of their financial well-being, promoting transparency and accountability in their money management endeavors.

Benefits of Cash App Bank Statements

Cash App bank statements offer a myriad of benefits that empower users to gain valuable insights into their financial activities and enhance their overall money management experience. By leveraging these bank statements, individuals can unlock a range of advantages that contribute to their financial well-being and decision-making capabilities.

Transparency and Accountability

Cash App bank statements promote transparency by providing a detailed breakdown of financial transactions, income sources, expenses, and investment activities. This transparency fosters greater accountability in managing personal finances, as users can track their monetary interactions with precision. By having a clear overview of their financial behaviors, individuals can make informed decisions and identify areas for improvement in their spending and saving habits.

Financial Tracking and Analysis

The availability of bank statements within the Cash App platform enables users to track and analyze their financial activities with ease. Whether it involves monitoring monthly expenses, reviewing income sources, or assessing investment performance, these statements offer a comprehensive view of one's financial landscape. This tracking and analysis capability empowers users to identify trends, recognize patterns, and make strategic adjustments to optimize their financial management strategies.

Budgeting and Planning

Cash App bank statements serve as valuable tools for budgeting and financial planning. By examining their expenditure patterns and income streams, users can create realistic budgets, set financial goals, and allocate funds more effectively. The insights gleaned from these statements enable individuals to make informed decisions about their spending priorities, thereby promoting responsible financial planning and fostering a proactive approach to managing their money.

Documentation for Financial Transactions

The bank statements provided by Cash App serve as official documentation of financial transactions, offering a reliable record of monetary interactions within the platform. This documentation proves valuable for tax purposes, financial audits, and general record-keeping. Users can refer to these statements to reconcile their financial records, verify specific transactions, and maintain organized documentation of their Cash App activities.

Empowerment Through Financial Insights

Ultimately, Cash App bank statements empower users with valuable financial insights that enable them to make informed decisions and take control of their monetary well-being. By gaining a comprehensive understanding of their financial behaviors, individuals can cultivate responsible money management habits, identify areas for improvement, and work towards achieving their long-term financial objectives.

The availability of bank statements within the Cash App ecosystem represents a valuable resource for users seeking to elevate their financial awareness and enhance their financial decision-making capabilities. By leveraging these statements, individuals can embark on a journey towards improved financial literacy, transparency, and empowerment in managing their personal finances.

Potential Issues with Cash App Bank Statements

While Cash App bank statements offer valuable insights into financial activities, it's essential to acknowledge potential issues that users may encounter when leveraging this feature. Understanding these considerations can help individuals navigate their financial management with greater awareness and preparedness.

Limited Transaction Details

Cash App bank statements may present limitations in providing comprehensive transaction details, especially for certain types of transactions. Users may find that specific information, such as detailed merchant names or transaction categories, is not as extensively documented in the statements. This can potentially hinder the ability to perform in-depth categorization and analysis of transactions, impacting the precision of financial tracking and budgeting efforts.

Delayed Transaction Updates

Another potential issue relates to the timing of transaction updates within the bank statements. Users may experience delays in the reflection of certain transactions, particularly those involving pending or processing status. This delay can lead to discrepancies between the actual transaction timing and its appearance in the bank statements, potentially affecting the accuracy of financial reporting and analysis.

Limited Customization Options

Cash App bank statements may have limited customization options, restricting users from tailoring the presentation and categorization of their financial data according to their specific preferences. The absence of robust customization features could impede users who seek a more personalized and detailed representation of their financial activities within the statements.

Security and Privacy Concerns

As with any financial documentation, security and privacy concerns are paramount. While Cash App implements robust security measures, users should remain vigilant about protecting their bank statements from unauthorized access. Additionally, the potential for sensitive financial information to be compromised through unauthorized access or data breaches underscores the importance of maintaining stringent security practices when accessing and storing these statements.

Compatibility and Accessibility

Users may encounter compatibility and accessibility challenges when attempting to access their Cash App bank statements across different devices or platforms. Ensuring seamless access and consistent presentation of the statements regardless of the user's device or operating system is crucial for optimizing the user experience and promoting accessibility.

By being mindful of these potential issues, users can approach the utilization of Cash App bank statements with a balanced perspective, leveraging the benefits while proactively addressing any challenges that may arise. It's essential for individuals to remain informed and adaptable, seeking alternative solutions when navigating potential issues to uphold effective financial management practices within the Cash App ecosystem.

Conclusion

In conclusion, the discovery of the bank statements feature within Cash App unveils a valuable resource for users seeking to enhance their financial awareness and management capabilities. By gaining access to comprehensive bank statements, individuals can embark on a journey towards improved financial literacy, transparency, and empowerment in managing their personal finances.

The benefits of Cash App bank statements are multifaceted, offering transparency, accountability, and valuable insights into financial activities. Through detailed transaction histories, income tracking, expense analysis, and investment records, users can gain a comprehensive understanding of their monetary interactions within the Cash App ecosystem. This understanding empowers them to make informed decisions, optimize their spending and saving habits, and strategically plan for their financial future.

While the availability of bank statements presents significant advantages, it's crucial for users to remain mindful of potential issues such as limited transaction details, delayed transaction updates, and security concerns. By acknowledging these considerations, individuals can approach the utilization of Cash App bank statements with a balanced perspective, leveraging the benefits while proactively addressing any challenges that may arise.

Ultimately, the provision of bank statements within Cash App represents a significant step towards promoting financial transparency and accountability. It equips users with the tools to track, analyze, and plan their financial activities with precision, fostering responsible money management habits and informed decision-making.

As users continue to harness the power of Cash App bank statements, they are encouraged to remain proactive in leveraging these insights to optimize their financial well-being. Whether it involves creating realistic budgets, identifying opportunities for financial growth, or maintaining organized documentation for future reference, the utilization of bank statements serves as a cornerstone for fostering financial empowerment and resilience.

In essence, the discovery of Cash App bank statements serves as a testament to the platform's commitment to enhancing the financial capabilities of its users. By leveraging this feature, individuals can embark on a transformative journey towards greater financial understanding, transparency, and control, ultimately shaping a more secure and informed financial future.