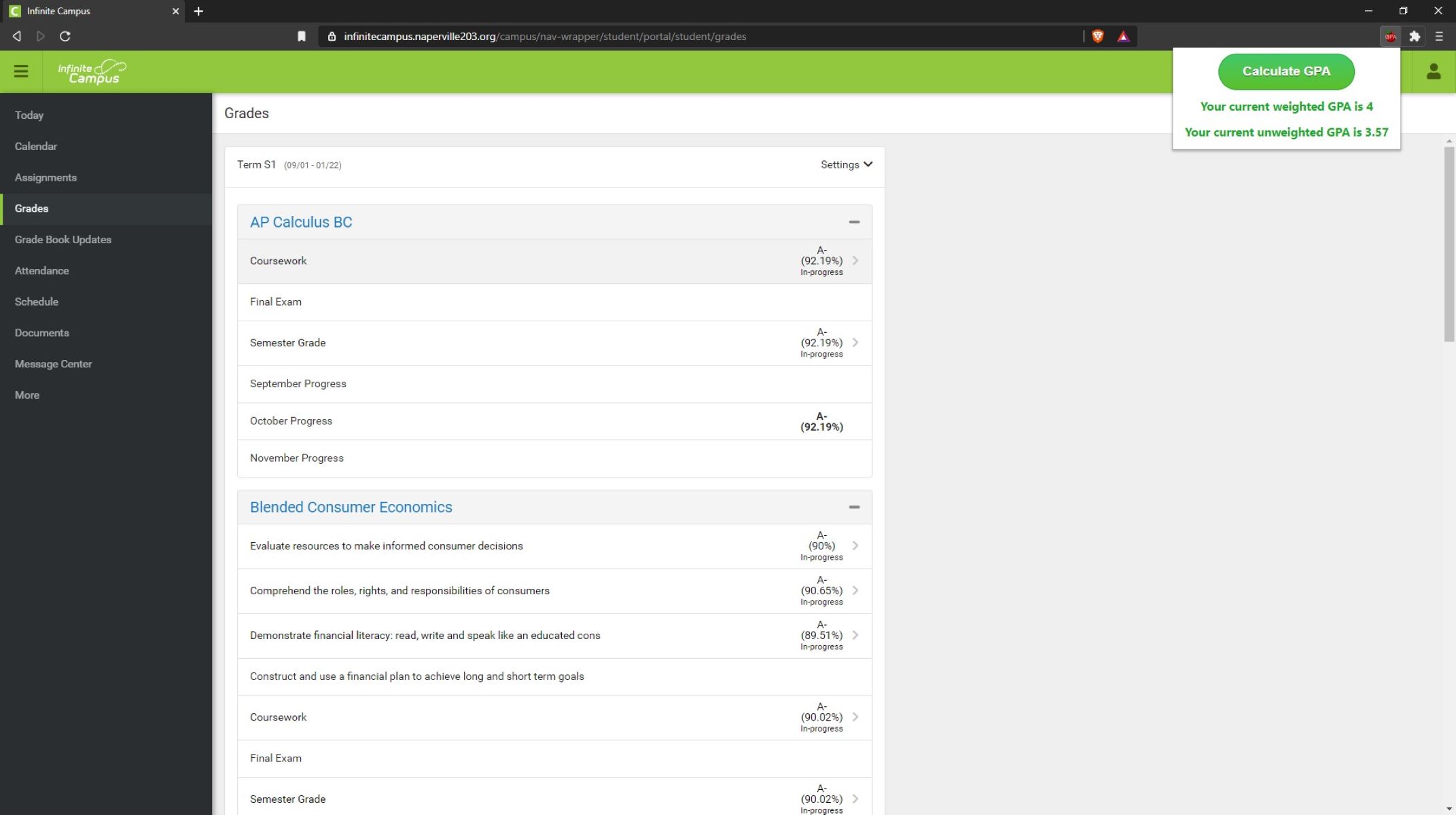

Home>Business and Finance>Target’s Surprising Policy: No Cash For Your Check!

Business and Finance

Target’s Surprising Policy: No Cash For Your Check!

Published: February 16, 2024

Learn about Target's surprising policy of not offering cash for check payments. Find out how this impacts your business and finance strategies. Discover alternatives to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Regretless.com, at no extra cost. Learn more)

Table of Contents

Introduction

In today's fast-paced world, the way we handle financial transactions has evolved significantly. The convenience and efficiency of digital payments have led to a surge in cashless transactions, with many individuals and businesses embracing this modern approach. However, this shift has sparked debates and raised concerns about the potential exclusion of individuals who rely on traditional payment methods.

As the popularity of cashless transactions continues to rise, major retailers are implementing policies that restrict or eliminate the use of cash in their stores. This trend has generated significant attention and sparked discussions about the implications for consumers and the broader economy.

In this article, we will delve into the recent decision by Target, a prominent retail chain, to implement a surprising policy that prohibits customers from using cash to purchase items with checks. This bold move has ignited a wave of reactions from customers and industry observers, prompting a closer examination of the impact of such policies on consumers and the future of traditional payment methods.

With the stage set for a thought-provoking exploration, we will unravel the implications of this policy, analyze the responses it has elicited, and consider the broader implications for the retail industry and the evolving landscape of financial transactions. Join us as we navigate through the intricacies of Target's cashless policy and the ripple effects it has generated.

The Rise of Cashless Transactions

The modern era has witnessed a profound shift in the way financial transactions are conducted, with a notable surge in the adoption of cashless payment methods. This transformation has been fueled by the widespread availability of digital payment technologies, the convenience of mobile wallets, and the increasing prevalence of contactless payment options. As a result, consumers are embracing the efficiency and seamlessness of cashless transactions, leading to a gradual decline in the use of physical currency.

One of the primary drivers behind the rise of cashless transactions is the unparalleled convenience they offer. With the advent of mobile payment apps and digital wallets, individuals can effortlessly complete transactions with just a few taps on their smartphones. This level of convenience has reshaped consumer expectations, prompting a growing preference for cashless payment methods across various retail and service sectors.

Furthermore, the ongoing digitalization of the financial landscape has paved the way for innovative payment solutions, such as biometric authentication and tokenization, which enhance security and streamline the payment process. These advancements have instilled a sense of trust and confidence in cashless transactions, further accelerating their adoption among a diverse range of consumers.

In addition to convenience and security, the proliferation of cashless transactions has been driven by the seamless integration of digital payment options in everyday activities. Whether it's purchasing groceries, paying for transportation, or settling utility bills, the ease of using digital payment methods has become deeply ingrained in modern lifestyles. This integration has not only simplified transactions but has also contributed to the gradual phasing out of traditional cash-based interactions.

Moreover, the global shift towards cashless economies has been underscored by the increasing prevalence of contactless payment technologies, which have gained significant traction, particularly in the wake of the COVID-19 pandemic. Contactless payments offer a hygienic and efficient alternative to handling physical currency, aligning with evolving health and safety considerations.

As cashless transactions continue to gain momentum, the financial landscape is witnessing a fundamental shift, with traditional payment methods making way for innovative digital alternatives. This evolution has profound implications for businesses, consumers, and the broader economy, signaling a transformative era in the way financial transactions are conducted.

Target's No Cash for Checks Policy

Target, a prominent retail giant, recently made waves in the industry by implementing a surprising policy that restricts customers from using cash to pay for items with checks. This bold move, aimed at streamlining payment processes and enhancing operational efficiency, marks a significant departure from traditional payment practices and has sparked widespread interest and debate.

The policy, which prohibits customers from using cash to pay for purchases made with checks, represents a strategic shift towards promoting cashless transactions within Target stores. By disallowing the use of cash for check payments, the retail chain is signaling a clear commitment to embracing digital payment methods and modernizing the customer payment experience.

This decision reflects Target's proactive stance in aligning with the evolving preferences of consumers, who are increasingly gravitating towards cashless payment options. By prioritizing digital transactions and discouraging the use of cash for check payments, Target is aiming to streamline its checkout processes, reduce cash handling costs, and enhance overall operational efficiency.

Furthermore, the implementation of this policy underscores Target's recognition of the growing significance of digital payments in the retail landscape. With the widespread availability and acceptance of various digital payment solutions, including credit and debit cards, mobile wallets, and contactless payment options, consumers have increasingly embraced the convenience and security offered by cashless transactions.

While the policy may initially appear surprising to some customers, it reflects a strategic response to the shifting dynamics of consumer behavior and payment preferences. Target's decision to disallow cash for check payments aligns with the broader industry trend towards fostering a seamless and efficient payment ecosystem, catering to the evolving needs and expectations of modern consumers.

The introduction of Target's no cash for checks policy serves as a compelling example of a major retailer proactively adapting to the changing landscape of financial transactions. By embracing digital payment methods and promoting cashless transactions, Target is positioning itself at the forefront of the retail industry's digital transformation, setting a precedent for other players in the market.

As the retail sector continues to navigate the ongoing digital revolution, Target's innovative policy underscores the pivotal role of cashless transactions in shaping the future of retail payments. This strategic move not only reflects Target's commitment to operational excellence but also signals a broader industry shift towards embracing the efficiency and convenience of digital payment methods.

In summary, Target's decision to implement a no cash for checks policy underscores the company's forward-thinking approach to modernizing the payment experience for customers. By prioritizing cashless transactions and digital payment methods, Target is not only addressing the evolving needs of consumers but also setting a compelling precedent for the future of retail payments.

Customer Reactions

The implementation of Target's no cash for checks policy has elicited a diverse range of reactions from customers, sparking a wave of discussions and debates across various platforms. As news of the policy spread, customers expressed a spectrum of sentiments, reflecting a mix of surprise, skepticism, and understanding.

Many customers who have been accustomed to the traditional practice of using cash to pay for purchases made with checks were initially taken aback by Target's decision. The unexpected nature of the policy prompted some to voice concerns about the potential inconvenience it may pose, particularly for those who prefer the flexibility of using cash for check payments. Additionally, some customers expressed apprehension about the implications of the policy on individuals who may not have access to digital payment methods or prefer to manage their expenses using traditional means.

On the other hand, a segment of customers exhibited a sense of understanding and openness towards Target's cashless policy. Recognizing the broader industry trend towards digital payments and the increasing prevalence of cashless transactions, these customers acknowledged the rationale behind Target's strategic shift. They emphasized the convenience and security offered by digital payment methods and expressed willingness to adapt to the evolving payment landscape.

Furthermore, the policy sparked discussions among customers regarding the broader implications of cashless transactions and the future of traditional payment methods. Some customers deliberated on the potential impact of similar policies across the retail industry, contemplating the implications for individuals who rely on cash and checks for their day-to-day transactions. This reflective discourse underscored the significance of Target's policy in sparking broader conversations about the evolving dynamics of financial transactions and consumer preferences.

Overall, the customer reactions to Target's no cash for checks policy reflect a spectrum of perspectives, highlighting the complex interplay between tradition and innovation in the realm of retail payments. While some customers expressed initial surprise and apprehension, others demonstrated a readiness to embrace the shift towards digital payments. The diverse range of reactions underscores the nuanced nature of consumer sentiments and the multifaceted considerations surrounding the evolution of payment practices in the retail landscape.

Target's Response

In response to the varied reactions and discussions surrounding its no cash for checks policy, Target has proactively engaged with customers and stakeholders to provide clarity and context regarding the strategic rationale behind the implementation of this bold initiative. The company's response reflects a commitment to fostering transparency and open communication, aiming to address concerns while emphasizing the broader vision driving the policy.

Target has underscored that the decision to disallow the use of cash for check payments is rooted in the pursuit of operational efficiency, enhanced customer experience, and alignment with evolving payment preferences. By streamlining the checkout process and promoting digital payment methods, the retail chain seeks to optimize its operational workflows, reduce cash handling costs, and elevate the overall shopping experience for customers.

Furthermore, Target has emphasized its dedication to catering to the evolving needs of modern consumers, acknowledging the increasing prevalence of digital payment methods and the convenience they offer. The company's response highlights its commitment to embracing innovation and adapting to the changing dynamics of the retail landscape, aligning with broader industry trends towards cashless transactions.

In engaging with customers and stakeholders, Target has conveyed a message of adaptability and forward-thinking, emphasizing the need to evolve alongside consumer preferences and technological advancements. The company's response reflects a proactive approach to addressing concerns and fostering a deeper understanding of the strategic imperatives driving the no cash for checks policy.

Moreover, Target has reiterated its commitment to ensuring accessibility and inclusivity for all customers, recognizing the diverse range of payment preferences and the importance of accommodating traditional methods while embracing digital innovations. The company's response underscores a balanced approach that seeks to harmonize modernization with inclusivity, striving to create a payment ecosystem that caters to the needs of a broad spectrum of consumers.

Overall, Target's response to the discussions surrounding its no cash for checks policy exemplifies a thoughtful and strategic approach to engaging with customers and stakeholders. By articulating the rationale behind the policy and emphasizing its commitment to operational excellence and customer-centricity, the company has sought to foster transparency and understanding, laying the groundwork for a continued dialogue on the evolving landscape of retail payments.

The Future of Cashless Policies

The implementation of cashless policies by major retailers such as Target serves as a compelling indicator of the evolving trajectory of financial transactions. As the retail landscape continues to embrace digital payment methods and streamline cashless transactions, the future of cashless policies holds profound implications for consumers, businesses, and the broader economy.

Looking ahead, the future of cashless policies is poised to witness a sustained momentum, driven by a confluence of technological innovation, shifting consumer preferences, and industry dynamics. The ongoing advancements in digital payment technologies, including the proliferation of mobile wallets, contactless payment solutions, and biometric authentication, are poised to further bolster the prevalence and acceptance of cashless transactions. This technological evolution will continue to enhance the convenience, security, and efficiency of digital payments, reinforcing their appeal to a diverse spectrum of consumers.

Moreover, the future of cashless policies is intricately linked to the broader trend towards digital transformation across industries. As businesses increasingly prioritize operational agility, cost efficiency, and seamless customer experiences, cashless policies are poised to emerge as a cornerstone of modernized payment ecosystems. Retailers, financial institutions, and service providers are likely to further embrace cashless policies as a means to optimize their operational workflows, reduce cash handling costs, and elevate the overall efficiency of their payment processes.

In addition, the future of cashless policies will be shaped by the ongoing societal shift towards digital lifestyles and the growing reliance on digital platforms for everyday activities. With the pervasive integration of digital payment methods in various facets of daily life, from e-commerce transactions to peer-to-peer payments, the normalization of cashless transactions will continue to gather momentum. This normalization is expected to further solidify the position of cashless policies as a strategic imperative for businesses seeking to align with evolving consumer behaviors and preferences.

Furthermore, the future of cashless policies will necessitate a nuanced approach that balances innovation with inclusivity, ensuring that traditional payment methods remain accessible while promoting the adoption of digital alternatives. As the retail landscape evolves, it will be crucial for businesses to navigate the transition towards cashless policies in a manner that accommodates the diverse needs of consumers, including those who rely on cash and traditional payment methods.

In summary, the future of cashless policies holds significant promise and complexity, reflecting the multifaceted interplay between technological innovation, consumer dynamics, and industry trends. As businesses and consumers continue to navigate the digital frontier, the trajectory of cashless policies will unfold as a pivotal aspect of the evolving financial landscape, shaping the way transactions are conducted and experienced in the years to come.