Home>Technology and Computers>Brigit App: Scam Or Legit?

Technology and Computers

Brigit App: Scam Or Legit?

Published: February 5, 2024

Discover the truth about the Brigit app - is it a scam or legit? Get the latest insights and reviews on this technology and computers platform.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Regretless.com, at no extra cost. Learn more)

Table of Contents

Introduction

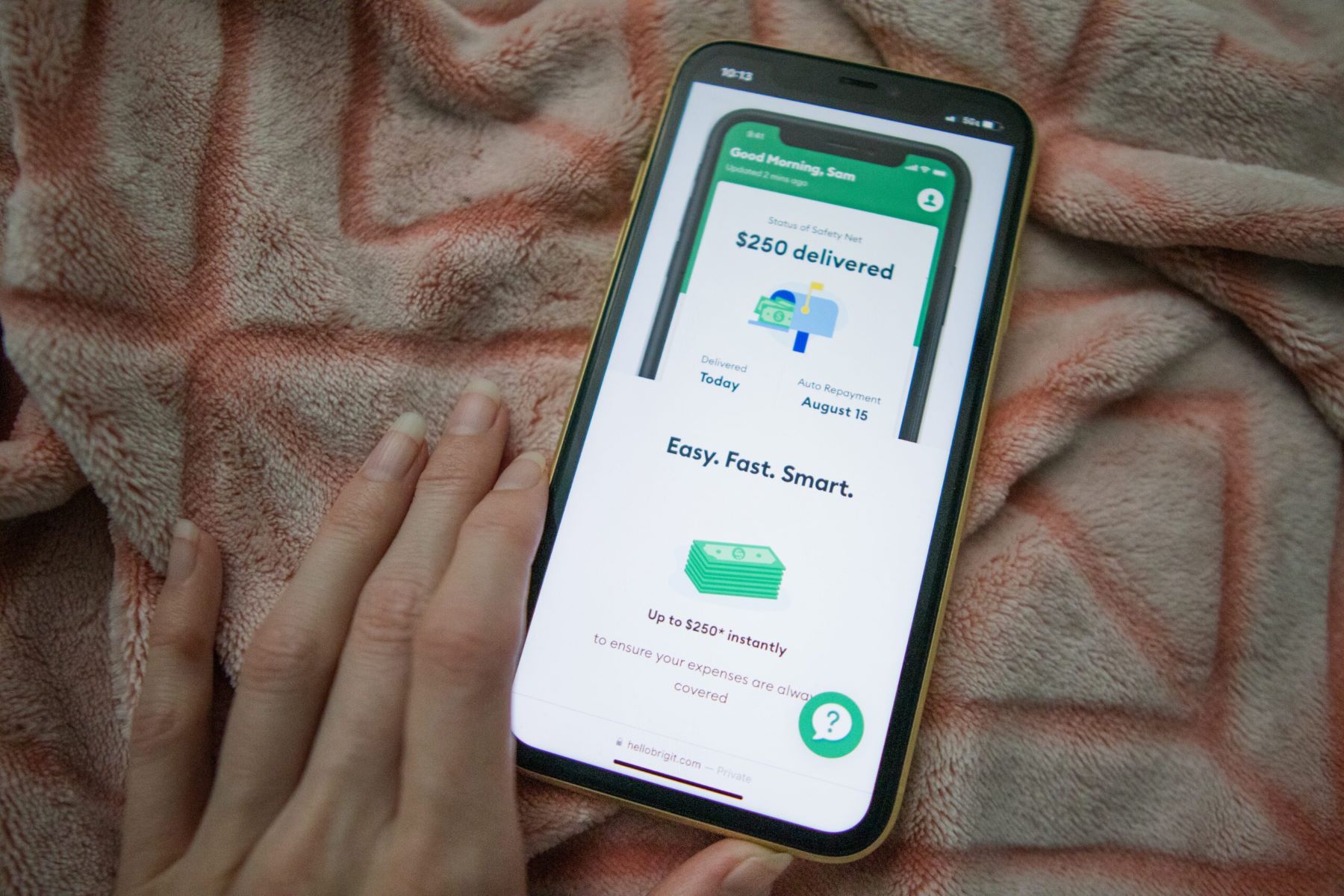

Brigit App has garnered significant attention in the realm of personal finance, sparking curiosity and skepticism in equal measure. As technology continues to revolutionize various aspects of our lives, the emergence of financial management apps has offered individuals a convenient means of navigating their monetary affairs. Among these apps, Brigit App has emerged as a prominent player, promising to alleviate financial stress and provide a safety net for unexpected expenses.

The allure of Brigit App lies in its purported ability to offer advances on earned income, thereby bridging the gap between paychecks and assisting users in managing their cash flow. This premise has piqued the interest of countless individuals seeking a reliable solution to financial uncertainties. However, amidst the enthusiasm surrounding this app, questions persist regarding its legitimacy and effectiveness. As such, it is imperative to delve into the workings of Brigit App, assess its credibility, and explore user experiences to discern whether it stands as a beacon of financial empowerment or a potential pitfall for unsuspecting users.

What is Brigit App?

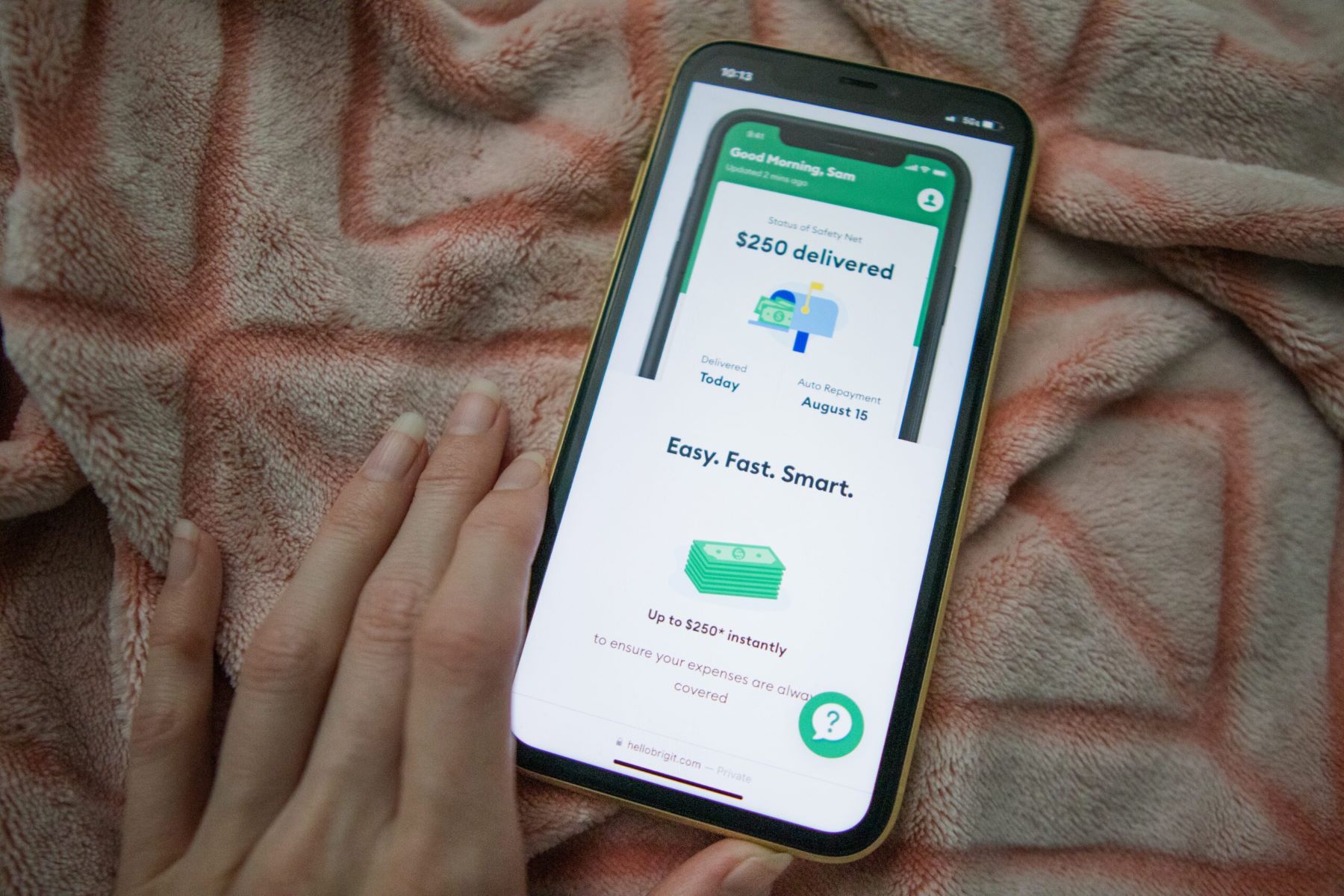

Brigit App is a financial tool designed to provide users with a safety net for managing their cash flow between paychecks. This mobile application aims to offer relief from the financial strain that often arises from unexpected expenses or temporary shortfalls in income. By leveraging technology and financial algorithms, Brigit App seeks to empower individuals to take control of their finances and avoid the pitfalls of late fees, overdraft charges, and high-interest payday loans.

At its core, Brigit App operates as a financial cushion, enabling users to access advances on their earned income to cover immediate expenses. This functionality is particularly valuable for individuals facing unexpected bills, medical expenses, or other urgent financial needs. By bridging the gap between paychecks, Brigit App endeavors to provide a sense of financial security and stability, thereby mitigating the anxiety often associated with financial uncertainty.

The app's user-friendly interface and seamless integration with users' bank accounts facilitate a streamlined experience, allowing for quick and efficient access to funds when needed. Furthermore, Brigit App emphasizes transparency and simplicity in its fee structure, aiming to provide a clear understanding of the costs associated with utilizing its services.

In essence, Brigit App represents a modern approach to financial management, leveraging technology to offer a lifeline for individuals navigating the complexities of personal finance. By providing access to earned income ahead of the scheduled payday, the app aims to alleviate the burden of financial emergencies and empower users to proactively address their monetary needs.

As we delve deeper into the workings of Brigit App, it becomes evident that its fundamental purpose is to serve as a reliable and accessible financial tool, offering a sense of security and control in an unpredictable financial landscape.

How Does Brigit App Work?

Brigit App operates through a seamless and intuitive process, designed to provide users with timely access to funds and alleviate the financial strain associated with unexpected expenses. The functionality of Brigit App can be encapsulated in the following steps:

-

Connection with Bank Account: To initiate the process, users are required to link their bank accounts with Brigit App. This integration enables the app to analyze the user's financial activity and assess their eligibility for advances on earned income.

-

Financial Analysis: Upon linking their bank accounts, Brigit App employs advanced algorithms to scrutinize the user's financial patterns, including income, spending habits, and upcoming expenses. This analysis enables the app to determine the user's eligibility for an advance and the amount that can be extended.

-

Advance Approval and Disbursement: Upon assessing the user's financial profile, Brigit App notifies the user of their eligibility for an advance. If approved, the requested funds are promptly disbursed to the user's linked bank account, providing immediate access to the required financial support.

-

Repayment Structure: The advance extended by Brigit App is designed to be repaid automatically upon the user's next paycheck. This seamless repayment structure eliminates the burden of managing additional due dates or accruing interest, offering a hassle-free experience for users.

-

Transparent Fee Structure: Brigit App prides itself on transparency, clearly outlining the associated fees and any applicable charges. This commitment to transparency ensures that users are fully aware of the costs involved, fostering a sense of trust and reliability in the app's services.

-

Optional Membership Benefits: In addition to its core functionality, Brigit App offers optional membership benefits, including financial tracking tools, credit monitoring, and additional financial resources. These supplementary features aim to enhance the overall financial well-being of users, complementing the app's primary function of providing advances on earned income.

In essence, Brigit App simplifies the process of accessing funds between paychecks, offering a lifeline for individuals facing unexpected financial challenges. By leveraging technology and financial insights, the app streamlines the experience of securing advances on earned income, thereby empowering users to navigate their financial obligations with confidence and ease.

Is Brigit App Legitimate?

The legitimacy of Brigit App is a pivotal consideration for individuals seeking reliable financial solutions. As users entrust the app with access to their financial data and rely on its services to navigate unexpected expenses, it is imperative to ascertain the legitimacy of Brigit App and the security it provides. In evaluating the legitimacy of Brigit App, several key aspects come to the forefront:

-

Regulatory Compliance: Brigit App operates as a financial technology platform and is subject to regulatory oversight to ensure compliance with industry standards and consumer protection laws. As such, the app adheres to stringent regulations governing financial services, underscoring its commitment to operating within the bounds of legal and ethical frameworks.

-

Security Protocols: The legitimacy of Brigit App is underscored by its robust security measures, aimed at safeguarding the privacy and financial data of its users. The app employs encryption protocols and multi-layered security mechanisms to mitigate the risk of unauthorized access and data breaches, instilling confidence in the app's commitment to user security.

-

Transparent Practices: A hallmark of legitimacy is transparency in operations, and Brigit App upholds this principle by providing clear and comprehensive information regarding its services, fees, and terms of use. This transparency fosters trust and empowers users to make informed decisions, reflecting the app's dedication to ethical and transparent practices.

-

User Protections: Legitimate financial platforms prioritize user protections, and Brigit App exemplifies this commitment through its adherence to fair lending practices and responsible financial conduct. The app's advances on earned income are structured to align with users' pay schedules, ensuring that the repayment process is seamless and devoid of exploitative practices.

-

User Feedback and Reputation: An integral aspect of assessing legitimacy is gauging user feedback and the app's reputation within the financial community. By analyzing user reviews and industry assessments, it becomes evident that Brigit App has garnered a positive reputation for its reliability, customer support, and commitment to empowering users with accessible financial solutions.

In light of these considerations, it becomes apparent that Brigit App stands as a legitimate and trustworthy financial tool, offering a viable avenue for individuals to navigate financial uncertainties with confidence and security. The app's adherence to regulatory standards, robust security measures, transparent practices, user protections, and positive reputation collectively affirm its legitimacy and position as a reputable financial platform.

Through its unwavering commitment to empowering users with accessible advances on earned income and fostering financial stability, Brigit App exemplifies the qualities of a legitimate and trustworthy financial ally, poised to alleviate the financial burdens of its users with integrity and reliability.

Brigit App Reviews

The realm of financial management apps is replete with diverse offerings, each vying for user trust and satisfaction. Within this landscape, Brigit App has garnered a plethora of reviews, offering valuable insights into the experiences and perceptions of its users. These reviews serve as a testament to the app's impact on individuals' financial well-being and provide a nuanced understanding of its functionality and efficacy.

User reviews of Brigit App underscore its role as a reliable financial lifeline, with many expressing appreciation for its seamless process of accessing advances on earned income. Users commend the app for its ability to provide timely financial support, particularly during unexpected emergencies or cash flow challenges. The convenience and accessibility of Brigit App's advances have been lauded by users, who emphasize the relief it offers in navigating unforeseen expenses without resorting to high-interest loans or incurring punitive fees.

Furthermore, Brigit App's transparent fee structure has garnered acclaim from users, who value the app's commitment to clarity and openness regarding associated costs. This transparency fosters trust and confidence among users, enabling them to make informed decisions about utilizing the app's services. Users also commend Brigit App for its user-friendly interface and intuitive design, which contribute to a seamless and hassle-free experience when availing advances on earned income.

In addition to its core functionality, Brigit App's optional membership benefits, including financial tracking tools and credit monitoring, have been positively received by users. These supplementary features are lauded for their contribution to overall financial well-being, complementing the app's primary function and enhancing the user experience.

It is important to note that while the majority of reviews express satisfaction with Brigit App, a nuanced perspective is also evident. Some users have highlighted the importance of understanding the app's terms and conditions, particularly regarding advance repayments and eligibility criteria. This emphasis on informed usage underscores the significance of comprehending the app's processes and obligations, ensuring a seamless and positive experience for users.

Overall, the reviews of Brigit App paint a picture of a financial tool that has resonated with users seeking reliable and accessible solutions to their financial needs. The app's ability to provide advances on earned income, coupled with its transparency, user-friendly interface, and supplementary benefits, has garnered widespread acclaim and positioned Brigit App as a trusted ally in navigating the complexities of personal finance.

Read more: The Truth About ‘ZOX’: Scam Or Legit?

Conclusion

In conclusion, Brigit App emerges as a beacon of financial empowerment, offering a legitimate and reliable solution for individuals navigating the unpredictable terrain of personal finance. The app's seamless process of providing advances on earned income serves as a lifeline for users facing unexpected expenses or temporary cash flow challenges, alleviating the burden of financial uncertainty with efficiency and transparency.

By leveraging technology and financial insights, Brigit App transcends the traditional constraints of financial management, empowering users to proactively address their monetary needs without succumbing to the pitfalls of high-interest loans or punitive fees. The app's commitment to regulatory compliance, robust security measures, and transparent practices underscores its legitimacy and positions it as a trustworthy financial ally.

Moreover, the user reviews of Brigit App offer compelling testament to its impact, with users expressing appreciation for its timely financial support, transparent fee structure, and supplementary membership benefits. The app's user-friendly interface and intuitive design further contribute to a positive user experience, fostering trust and confidence among its diverse user base.

In essence, Brigit App stands as a testament to the transformative potential of financial technology, offering a tangible solution to the financial challenges faced by individuals. Its unwavering commitment to providing accessible advances on earned income, coupled with its adherence to ethical and transparent practices, solidifies its position as a reputable and reliable financial tool.

As individuals continue to seek accessible and trustworthy avenues for managing their finances, Brigit App emerges as a steadfast ally, offering a sense of financial security and control in an ever-evolving financial landscape. Through its seamless process, transparent practices, and positive user experiences, Brigit App exemplifies the qualities of a legitimate and impactful financial platform, poised to empower users and alleviate the burdens of financial uncertainty with integrity and reliability.